Intermarket analysis is a powerful tool that gives traders/investors a macro predictive direction of stocks, bonds, commodities and currencies. Intermarket analysis states that all asset classes are interrelated and that you can’t definitively determine the direction of one asset class without examining the other asset classes.

There are several key relationships that bind these four markets together. These relationships include:

The INVERSE relationship between commodities and bonds.

The INVERSE relationship between bonds and stocks.

The POSITIVE relationship between stocks and commodities.

The INVERSE relationship between the US Dollar and commodities.

The overall goal of the intermarket analysis is to identify top performers or the markets that are outperforming others. With all that said, the top and worst performers from this past week are the following:

Top Performers

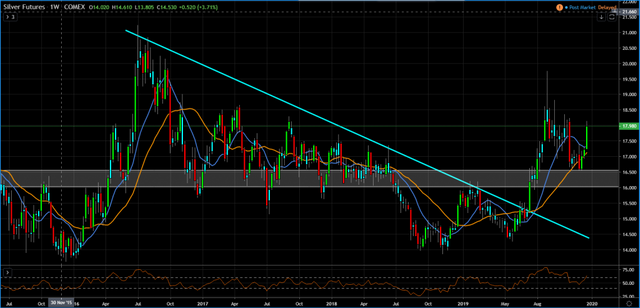

Silver : 4.60%

Silver is rising and has found a floor at $16 because of doubt about the US-China phase 1 deal, concerns about President Trump’s recent impeachment by the House and worries about stock market valuations being too rich. Many on Wall Street are calling for a correction in the equity markets in 2020, which is why silver caught bids this week.

Hard Red Wheat : 4.18%

American wheat farmers grow six classes of wheat. Each wheat variety fits into one of these six categories based on the growing season (winter or spring), hardness (hard or soft) and color (red or white).

Ninety five percent of the wheat grown in Kansas is hard red winter (HRW). In fact, Kansas farmers grow more HRW wheat than any other state.

With high protein and strong gluten, HRW wheat is ideal for yeast bread and rolls. But, this versatile class is also used in flat breads, tortillas, cereal, general purpose flour and Asian-style noodles.

HW wheat is used for whole wheat white flour, due to its naturally milder, sweeter flavor. Bakers also use HW wheat in pan breads, tortillas, flat breads and Asian-style noodles.

Coffee: 4.17%

Worst Performers

Oats: -2.94%

Oats are a cereal commonly eaten in the form of oatmeal or rolled oats. According to some research, they may have a range of potential health benefits. A low-glycemic impact of a bowl of oatmeal eaten in the morning provides a good source of energy throughout the morning hours, without a dramatic increase or drop in blood sugar.

The oat market looks set to come under further pressure, with analysts suggesting 2019 produced the biggest crop since the 1970s and spring oat plantings forecast to rise sharply next year.

Orange Juice: -2.36%

Lumber: -1.94%

Timber is a term for wood that has been cut down, in one form or another. Lumberjacks traditionally shout the word as a warning that a tree has been cut down and is about to fall, for safety purposes.

Housing starts in the US grew +3.2% in November to a seasonally adjusted annual rate of 1.365 million and the pace for October was revised upward, according to the Department of Housing and Urban Development and the Department of Commerce December 17. Lumber is the basis of all residential home and based on the up trendline on the chart, I don’t anticipate lumber being on the worst performer list in the weeks to come.

See you next week.

This post is my personal opinion. I’m not a financial advisor, this isn’t financial advise. Do your own research before making investment decisions.

Get involved!

Comments