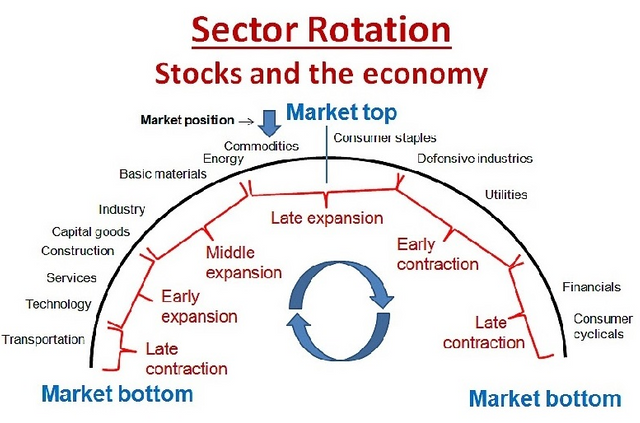

Sector rotation is the action of shifting investment assets from one sector to another to take advantage of cyclical trends in the overall economy in an attempt to beat the market. Sector rotation seeks to capitalize on the theory that not all sectors of the economy perform well at the same time because sectors of the stock market perform differently during the phases of the economic and market cycle.

For example, defensive sectors such as consumer staples, utility and health care stocks tend to outperform during a recessionary phase, while consumer discretionary and tech stocks tend to fare well during early expansions.

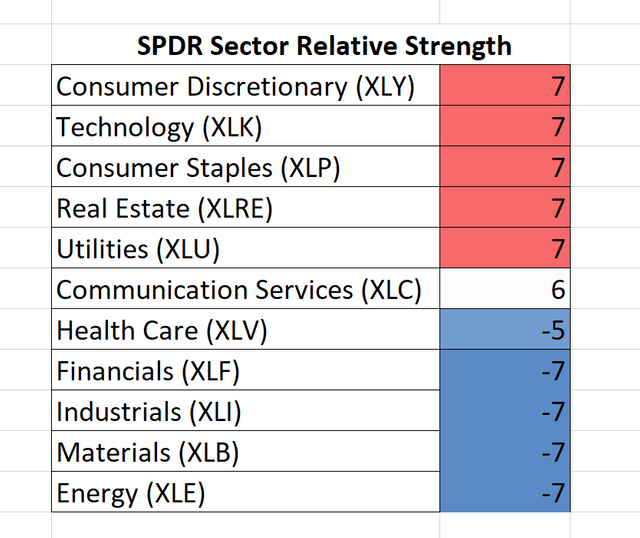

When you trade, you want the strongest stocks in the strongest sectors, which is why you should monitor sector performance carefully. With that said, lets determine the relative strength of the sectors relative to the S&P 500 ETF, SPY for the upcoming week.

Communication Services (XLC)

Consumer Discretionary (XLY)

Consumer Staples (XLP)

Energy (XLE)

Financials (XLF)

Health Care (XLV)

Industrials (XLI)

Materials (XLB)

Real Estate (XLRE)

Technology (XLK)

Utilities (XLU)

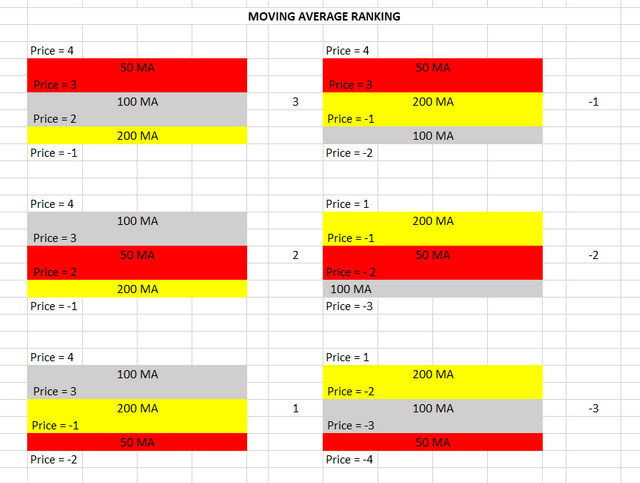

Based on the moving averages and the last daily closing price, relative to the moving averages,

the SPDR sectors’ relative strength, relative to the SPY are the following:

Two Weeks Ago

This post is my personal opinion. I’m not a financial advisor, this isn’t financial advise. Do your own research before making investment decisions.

Get involved!

Comments