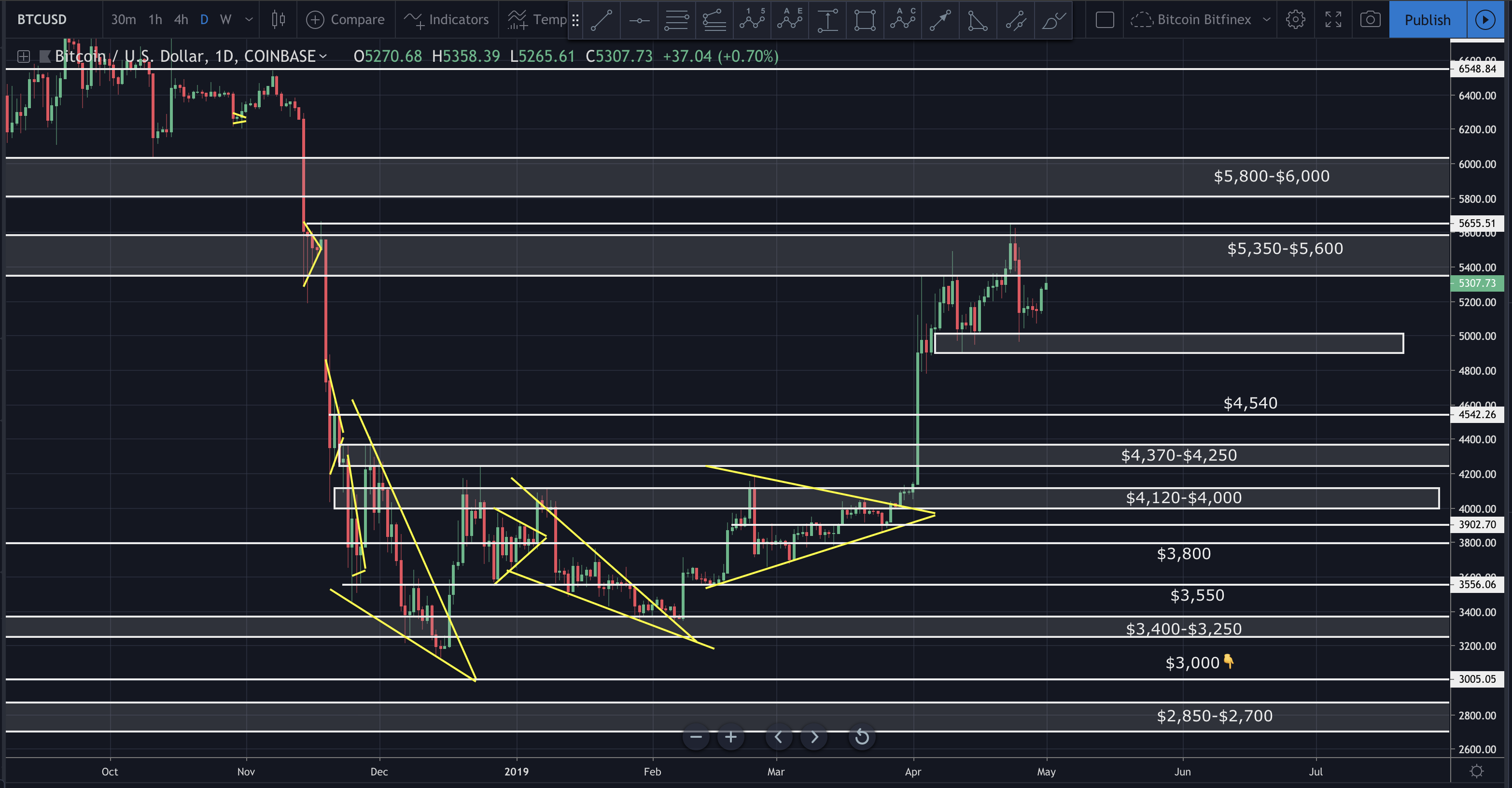

Bitcoin bounced nicely off the $5,000 support and is now testing $5,350 resistance. A decisive break above, turning $5,350 into support, would indicate a likely visit to at least $5,600. Daily volume remains steady above $13 billion.

Price consolidated just above the 21day EMA for 6 days without a decisive break below. This is a sign of strength.

Shorts remain stacked and longs are flat. Should a short squeeze occur, I can see price easily hitting $5,800. That said, the bears seem dug in. Bulls would likely have to push price north of $5,600 to start liquidating shorts.

In today’s video I analyze bitcoin, EOS, BAT, BNB, ETH and XRP. I’ll discuss key areas to watch, where prices may be heading next, where my entry and exit points are, traps to avoid and so much more. I hope you find it helpful.

*Correction in video: I discuss a “supply” zone around the 4:00 mark. I should have said “demand” zone.

Video Analysis:

If you don’t see the above video, navigate to TIMM (https://mentormarket.io/workin/) or Steemit in order to watch.

I hope this has been helpful. I’d be happy to answer any questions in the comment section below. Until next time, wishing you safe and profitable trading.

Workin

If you found this post informative, please:

Open a free account on Binance here:

https://www.binance.com/?ref=16878853

Get paid for viewing ads and Support the Crypto Ecosystem with Brave Browser. Free download here:

https://brave.com/wor485

Twitter handle is @Workin2005 and Facebook is https://www.facebook.com/Workin2005

Feature Image By: Saul Gravy

Get involved!

Comments