Santander Consumer USA Holdings Inc., a specialized consumer finance company, provides vehicle finance and third-party servicing in the United States. Its products and services include retail installment contracts and vehicle leases, as well as dealer loans for inventory, construction, real estate, working capital, and revolving lines of credit.

The company also offers financial products and services related to recreational and marine vehicles; originates vehicle loans through a Web-based direct lending program; purchases vehicle retail installment contracts from other lenders; and services automobile, and recreational and marine vehicle portfolios for other lenders.

Santander Consumer (SC) reported earnings this past week and their quarterly earnings of $0.67 per share beat Wall Street estimates of $0.66 per share. This compares to earnings of $0.64 per share a year ago. Over the last four quarters, the company has surpassed consensus EPS estimates three times. But don’t let the numbers fool you.

Santander Consumer is one of the largest subprime auto lenders in the market. Delinquencies for auto loans in general, including both prime and subprime, have reached their highest levels this year since 2011.

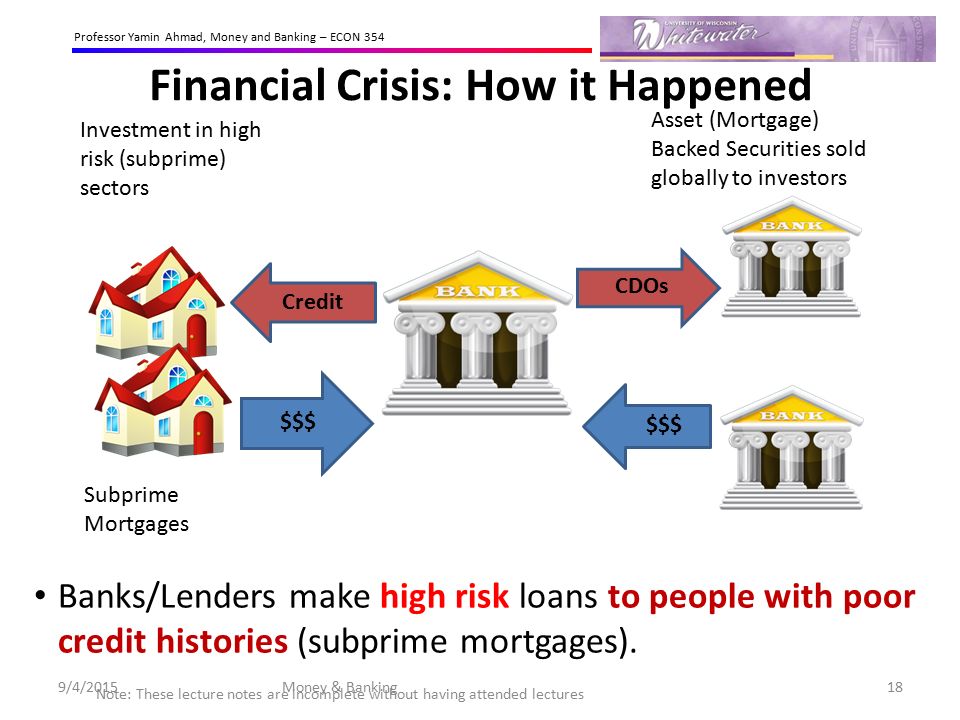

Prior to the Great Recession, banks were approving just about any applicant regardless of their income or ability to pay the mortgage. The banks didn’t care as they just packaged the loans as CDOs and sold them to Wall Street. All kinds of debt were repackaged and resold as collateralized debt obligations. As housing prices declined, many homeowners found they could no longer pay their mortgage resulting in mass defaults.

Santander Consumer does the same thing today. The package these auto loans and sell them to bond investors. But in Santander Consumer’s case, if the debt can’t be paid back Santander Consumer is often obliged to buy the loans back, which ends up being a loss on their books.

Santander Consumer had $26.3 billion of subprime auto loans as of June 30 that it either owned, or bundled into bonds, According to a report from S&P Global Ratings, Santander Consumer has more than $25 billion in subprime auto loans which is almost 50% of the company’s total managed loans.

Are you thinking what I’m thinking…the stock is setting up for a short. Based on the monthly chart, the chart is suggesting two targets.

With the first testing being the level at $23.

This post is my personal opinion. I’m not a financial advisor, this isn’t financial advise. Do your own research before making investment decisions.

Get involved!

Comments